If you’re thinking “What the heck are sinking funds?” you’re at the right place. I know it’s kind of a weird name – but trust me, it’s a smart and strategic savings approach that you want to know about.

At the end of this post you will be wondering why in the world you haven’t built it into your budget yet, because YES, it’s that amazing.

What are sinking funds?

Simply put, a sinking fund is a strategic way to save money for an expected future expense by intentionally setting aside a little bit each month.

Have you ever saved up money to buy something you wanted? If yes, well, then you’ve created a sinking fund! Yes, it’s that easy.

Say, for instance, you’re hosting a birthday party with a lot of guests 6 months from now. How do you plan on paying for it? Do you pull out your credit card? Do you cut down on the rest of your monthly budget? Or do you dip into your emergency savings?

Look, the truth is, such expenses can be very harmful to your financial situation. You need to have some kind of system in place to be able to pay for big expenses in cash, instead of putting yourself in debt. Believe it or not, creating a sinking fund IS that system.

You are saving money now because you know that you will need to pay for a specific expense later.

Why are sinking funds important?

- You’re prepared for your purchases/holidays/events with cash – no need to swipe your credit card and go into debt.

- Spending without regret because you don’t need to worry about where the money is coming from – you have planned and saved for this purchase!

- You can have fun without feeling guilty – buy that amazing gift for your kiddo or friend, take a trip to the place you’ve been dreaming about, get those beautiful Christmas decorations, buy that Roomba S9+ robot vacuum cleaner on a Black Friday – yes, I said that!

The truth is that certain expenses come up every year impacting your budget significantly and you need to pay for them.

What’s the difference between a sinking fund and an emergency fund?

Both sinking funds and emergency savings make you feel more at ease whenever the time comes when you need the money. They both give you more freedom to have the things you want without going into debt. However, they are created for different purposes.

Emergency funds are used for unexpected and unplanned expenses in your life such as family emergencies, home/car repairs, job loss, moving expenses, etc. Your goal should be to have 3-6 months of expenses saved for any kind of life emergency.

Sinking funds are created for planned and expected expenses. You know what you are saving for, how much money you need to save, and when you’re going to use it.

What’s the difference between a sinking fund and a savings account?

I believe the main difference between your sinking fund and a savings account is mainly in the desired outcome. Saving accounts are set up for long-term savings while also earning some interest each month. A savings account does not necessarily have a specific purpose and a time limit.

Sinking funds are meant to help with the PLANNED future expenses making them a lot less stressful to pay for.

How to create a sinking fund?

Step #1: Decide what you’re saving up for.

Let’s say you’re saving up for hosting a birthday party with a lot of guests (like in the example above). You will be saving a little bit every month so when that day comes you don’t have to dip into your emergency fund or pay with a credit card.

Step #2: Decide how much you need to save and what your target date is.

After you decide what it is you’re saving up for, you need to figure out how much should be saved and when the due date is. Do some research and be very realistic about how much money you will be spending.

Once you know that number, you will need to determine your monthly contributions. To do that, take the total amount that you will be spending and divide it by the number of months you have left until you make that purchase.

If you’re hosting a birthday party in 6 months, and $1000 is the maximum you will spend – you should stash away about $167 every month to reach that amount of $1000.

Step #3: Decide where you’re going to keep your sinking fund savings.

If you’re using a budget to track your income and spending instead of looking at your bank balance, it doesn’t matter where you keep the money.

I think a little self-examination could help you here. If you’re disciplined with your savings account and you don’t transfer your money in and out of it – you can create a savings account specifically for that sinking fund.

My credit union allows me to open as many savings accounts as I want, letting me keep my sinking funds separate. I assigned custom labels for each savings account and it’s very easy for me to transfer money every month. I also have instant access to it which makes it perfect for storing my sinking fund savings.

Another great way to do that is to use cash envelopes! If you’re an impulse buyer you’re going to be less tempted to spend the money because your sinking fund envelope/s will be at home, preferably hidden in a fireproof safe.

Investing that money in the market is not a good idea because sinking funds are considered short-term savings. You can put it into a high-interest savings account to earn some interest while it’s waiting to be used.

Wherever you decide to store your sinking fund savings, make sure that you can access your money instantly without any penalties or monthly fees.

Step #4: Add your sinking fund to your budget.

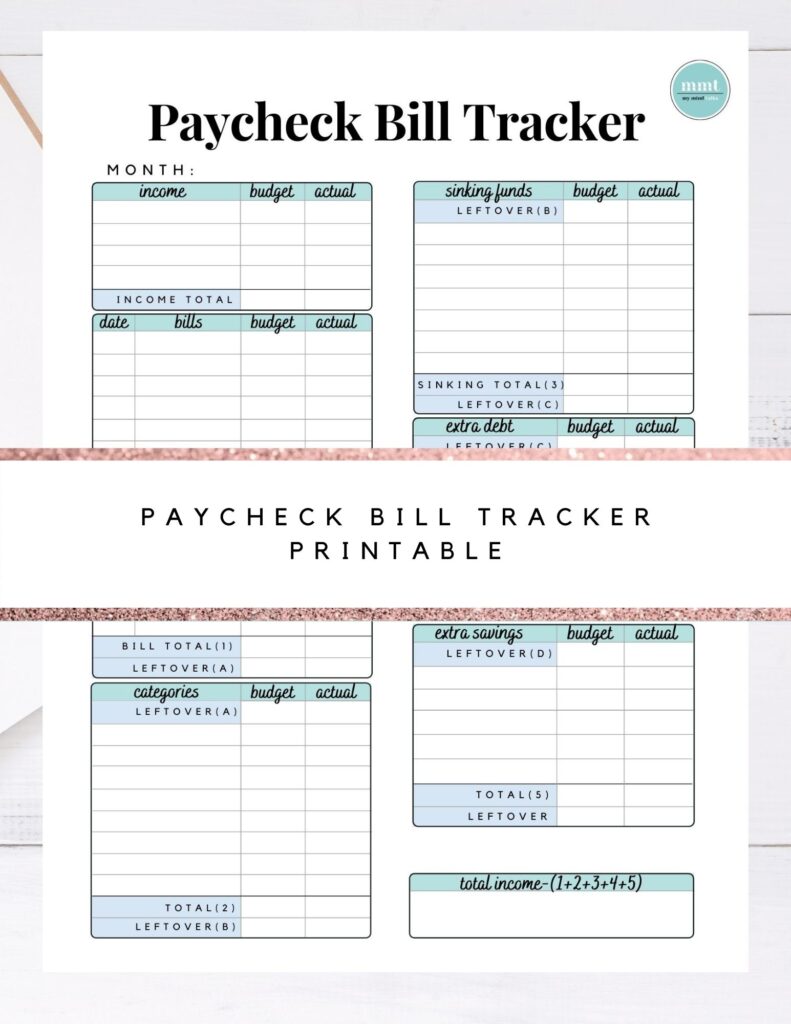

Whether you create your budget in Excel, in the app, or using my free budgeting worksheets and trackers, make sure you put your sinking fund line item in the budget, so it serves you as a constant reminder to put some money aside.

Download my free budgeting resource from the Resource Library– Paycheck Bill Tracker to help you allocate your income money towards all of your spending, including bills, categories (food, household, etc.), debt, sinking funds, extra savings, and rollover money. Your income minus your spending should equal 0.

Step #5: Start saving and make sure you track your progress.

Once your sinking fund is built into your budget, transfer the money regularly (monthly/weekly/daily – whatever you choose). Treat it like your bill that needs to be paid. Sometimes I challenge myself to save even more than I initially planned!

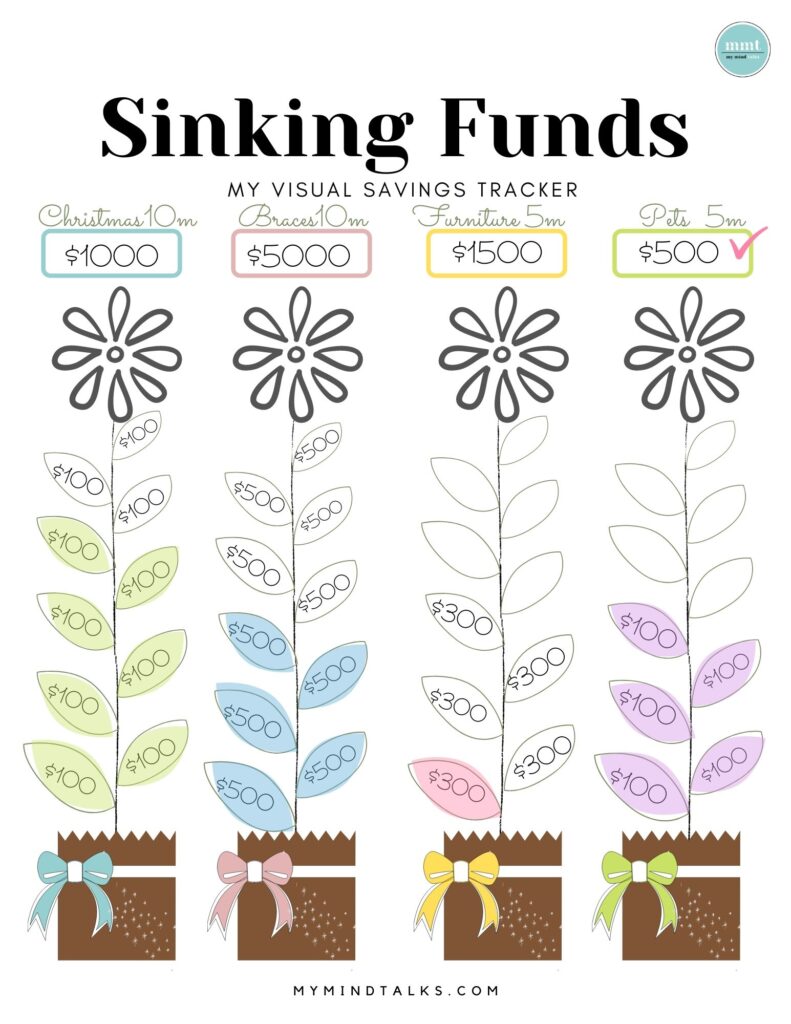

Download this cute Sinking Funds Tracker from the Free Resource Library to make it visual and keep yourself motivated.

How many sinking funds should we have?

This is a really good question, and the answer is it depends on your personality. I prefer keeping it simple and having fewer categories. If you have 50 different sinking funds going on all at once, you won’t see a lot of progress in any of them.

I think prioritizing plays a big role here. What future events and purchases are essential for you to be prepared for? What are the trade-offs if you decide to drop a certain category? Just remember, you don’t want to spend money that you don’t have, aka putting it on your credit card without having a solid plan of paying it off immediately.

Some sinking fund categories:

Here are some different sinking fund categories you can implement in your budget.

- Christmas

- Wedding

- Car repairs

- Car insurance

- Birthdays (friend’s/ kid’s/ spouse’s, etc.)

- Vacation

- Pets

- Back-to-school

- Medication

- Home maintenance

- Clothes

- Braces

- Tuition

- House downpayment

- Furniture

Wow, that was a pretty long read, wasn’t it? Now you know how to create a sinking fund.

Remember, saving up ahead of time prevents us from stress, anxiety, and what else? Yes! Debt!

Yes, you can add that home gym to your spare bedroom. Heck yes, you can buy that outfit. Yes, you can splurge on that gift for your loved one. Yes, you can go on that vacation of your dreams.

Of course, it takes time, dedication, and discipline, but hey, isn’t it worth it?

Let me know down below if you have any sinking funds. Are you saving up for something exciting? 🙂

Share this post if you enjoyed it, I would truly appreciate it! Thank you!

Read More:

How To Use The Cash Envelope System For Successful Budgeting

Top 21 Amazon Must-Haves That Will Save You Money

12 Good Spending Habits That Will Save You Money

Yes I started doing it too, managing finances by registering from the most important. It’s hard enough, but I’m more positive with restraint. thanks