Having financial goals to set and crush every year is an important step towards financial freedom and stability.

Achieving it takes much more than just luck. It requires you to be disciplined, organized, and dedicated. You even have to sacrifice to follow your short-term and long-term financial goals.

It’s not easy!

Here I decided to come up with 18 financial goals ideas that you can set right now and start moving towards them.

1. Become debt-free

Getting out of debt is one of the most important financial goals to set and crush this year! Other goals are important too but I put this one as number one because the faster you do it the better.

Here are some reasons why you should make it a goal to get out of debt:

- You get to choose what you want to do with the extra earnings that you were pouring into debt because you’re not obligated anymore. Whether you want to spend money on traveling or charity, it’s up to you now! What can be more motivating?

- If you pay off your debt you’ll also get rid of interest (sorry for being so obvious, but it’s true! ) which means you can put more money into your savings account.

- Knowing that you’re not expected to pay a certain amount of money on your credit cards, student debt, or auto loan is going to be such a relief!

- You can have more fun being debt-free.

- If you don’t like your job it’s going to be easier to quit and pursue your dreams knowing that you got out of debt.

2. Master budgeting skills

Creating a budget is essential if you’re trying to save money or pay off your debt. It helps you keep track of your finances and avoid overspending.

A budget is an actual plan that you create and follow. But the fact is not many people do it.

A Gallup poll found that only 32% of Americans maintain a household budget.

How budgeting can improve your life?

Well, one of the most important reasons to have a budget is because it helps you reach your goals!

Creating a budget plan helps you see and prioritize your spending. What do you need to focus on? What can you cut back on? How to do that? A budget plan answers those questions for you to reach your goals.

It can be saving up for a home, getting out of debt, saving money for creating your own business, and so on.

If you have a major goal having a budget is a must!

Budgeting can improve your life in many other ways such as leading to a happier retirement, preparing for emergencies, preventing you from overspending on unnecessary things, and more.

Here’s an article that can be helpful if you’re trying to save money.

This article can be helpful if you’re looking for a fun budgeting way to track your expenses and if you hate spreadsheets haha 14 Unnecessary Expenses That Hurt Your Wallet

Oh, and you can use my Monthly Budget Worksheet to create a realistic budget. It has instructions in case you don’t know how to use it!

What it can do? It can help you create a realistic budget and see where your money’s going. You can see what expenses you should cut back on or maybe it’s your income that should be improved.

3. Create your own business

I think at some point everybody should have their own business and I think it’s one of the most inspiring financial goals to set.

What are the advantages of starting your own business?

Well, one of the biggest advantages is being your own boss. You have more freedom and independence working for yourself.

Once your business is established you can always make sure to attend the most important events in your life, while working for somebody else doesn’t always give you this opportunity.

Another advantage is working for yourself is more fulfilling and exciting because you do what you enjoy doing, you sell services or products that you love.

Entrepreneurship can change a person’s life, and goals, and can teach a lot!

Whatever idea you’ve been having in your head for a long time, make it happen! Whether it’s a small blog like this one or a multi-employee company.

Life is short when if not now?

If you’re planning on creating a blog, I recommend Bluehost. It’s one of the best web hosting sites and it’s the one I’m using. Through my link, you can start your blog for as little as $3.95 per month (regular price is $7.99) plus you will get a free domain for a whole year (usually it’s $11.99/year). Oh! There’s also a 30-day money-back guarantee.

4. Achieve a perfect credit score

Improving your credit score is on the list of financial goals of many people. However, achieving it is not always possible and takes time.

It’s worth trying because:

- It can affect where you live. When you’re buying a house, if your credit score is low your loan application can get disapproved, or if it gets approved the interest rate is going to be high (and you don’t need that).

- Auto loans require good credit.

- The same with business loans.

Overall to live comfortably you need to have good credit, because mortgage lenders, utility providers, business landlords, and even employers look at your credit to see how responsible you’ve been with paying your bills. And it can affect the way you want to live.

So set a certain goal for yourself like 790, 800, or even 850, and move towards it.

5. Save more for retirement

The earlier you start saving and investing in your retirement the better off you’ll be, thanks to the principle of compounding.

A Bankrate survey found that 61% of Americans don’t know how much they will need to have saved to fund their retirement. And 21% of working Americans aren’t saving at all.

Here are some quick tips:

- Focus on starting today

- Contribute to your 401(k)

- Meet your employer’s match

- Consider opening an individual retirement account (IRA)

- Don’t forget about catch-up contributions if you are age 50 or older

6. Get a side hustle

Before choosing which side job you want to get, think of the main goal of why you’re getting it in the first place and how much time you’re willing to commit.

If your goal is to make some extra money fast consider:

- Taking online surveys with Survey Junkie, Swagbucks, Prize Rebel, VIP Voice, Vindale Research

- Get paid to test products with Pinecone Research

- Mystery shop for other people

- Start delivering using Uber Eats or Grubhub and more

But if your goal is to replace your full-time salary consider:

- Becoming a virtual assistant

- Proofreading

- Start a blog

- Do freelance writing and so on

You can read a list of jobs in high demand here.

7. Build an emergency fund

Building an emergency fund should definitely be on our financial goals list to achieve this year. Especially today, when we don’t know what life can bring. So having an emergency fund is crucial.

Experts recommend that we keep at least 3 months’ worth of living expenses in a separate savings account. But try to shoot for 6 months, it’s a great financial security blanket for ‘just in case’ situations.

8. Sell your own product

Creating and selling your own product should also be on the list of your financial goals to set and crush.

Why? Simply because if you have some great ideas to contribute to the world why not do it?

- If you love writing, write a book and sell

- If you enjoy painting, create a piece of art and sell it

- Write a song

- Create digital products

- Create a course and more!

9. Save for a vacation

Save money for your dream vacation and make it happen without falling into debt to fund it.

Whether your dream vacation is going on a cruise, visiting Australia, or going to Disney World make sure you don’t get yourself into a bad financial situation that you will have to struggle with later.

10. Read a set number of finance books

Don’t forget to set a goal to read some great personal finance books if you haven’t mastered your finances yet.

Knowledge is power and reading can make you smarter in the area that you want to improve.

11. Earn passive income

I think it’s one of the most desirable financial goals to set for many people.

Can you imagine what it feels like to earn money from something that you don’t have to physically work at? You can be sleeping and still make money. You can be elsewhere in the world and get paid.

Real estate, affiliate marketing, blogging (which is not always passive), having a business, or something else can bring you passive income.

Read about how people make money with affiliate marketing.

12. Automate your savings.

It’s very easy to get off track and save less than you intended when you’re not consistently transferring a portion of your paycheck to your savings account. That’s why if you haven’t done it yet do it right now.

You can also use Digit which is a smart app that analyzes your expenses and automatically moves money from your checking account to your Digit account when you can afford it.

Why I said that it’s a smart app because Digit knows exactly how much you spend and save, and it allows you unlimited withdrawals so you can access savings at any time.

13. Focus on your health

You’re probably wondering why focusing on your health is on the list of financial goals to set. Well, because healthcare is super expensive.

Did you know that the average American spent $10,345 on healthcare in 2016 according to CMS.gov? It’s a huge amount of money spent on being in good health, isn’t it?

That’s why taking care of your health is crucial if you want to spend less and stay healthy.

Get rid of the bad habits that you have. If you smoke, quit it, if you drink quit it, if you eat a lot of fast food but are trying to lose weight, reduce or eliminate it from your diet. Start healthy meal planning.

Those are just habits and you’re the one in control of them.

I know there’s a website called HealthyWage that encourages its users to achieve their weight loss and fitness goals by providing cash prizes!

You can get paid by losing weight, that’s crazy! It keeps you motivated because most of the time lack of motivation is the reason why people quit.

14. Save on utilities

Make it a goal to save on utilities this year.

Also, use Billshark to lower your cable, cell phone, internet, and insurance bills. This company negotiates your bills to lower them.

15. Automate your bill payments

If you haven’t done it yet it’s time to do it.

Automating your bill payments will save a lot of time and hassle. Knowing that your bills are paid on time will give you peace of mind.

16. Become more productive and organized

Boosting your productivity can change your relationship with money in a very positive way.

By learning how to be more efficient and productive you can find more time for doing your side jobs, and analyze your finances, you will have time and energy to create a budget.

Here at My Mind Talks, you can find a lot of time-management and productivity hacks to be more efficient.

Besides working on how to be more productive, you can be organized with your finances by using tools like Personal Capital.

It’s one of the best platforms to give you expert advice and financial planning services. It can help you manage your net worth, check your portfolio for excessive fees, manage your cash flow, and much more.

It’s a great tool to be super organized with your finances. And you can use it for free!

17. Eliminate unnecessary expenses

Eliminating unnecessary expenses is one of the best and fastest ways to start spending less and save more. However, it’s one of the biggest challenges in personal finance and sometimes people don’t know how to do that or simply don’t realize they need it.

Even though some of our regular bills might seem not very significant on their own, when they add up they can turn into a huge amount of money that we pay.

I think if you haven’t started eliminating unnecessary expenses it should be on your bucket list of financial goals this year.

I have a great post that includes 14 unnecessary expenses that you should cut right now.

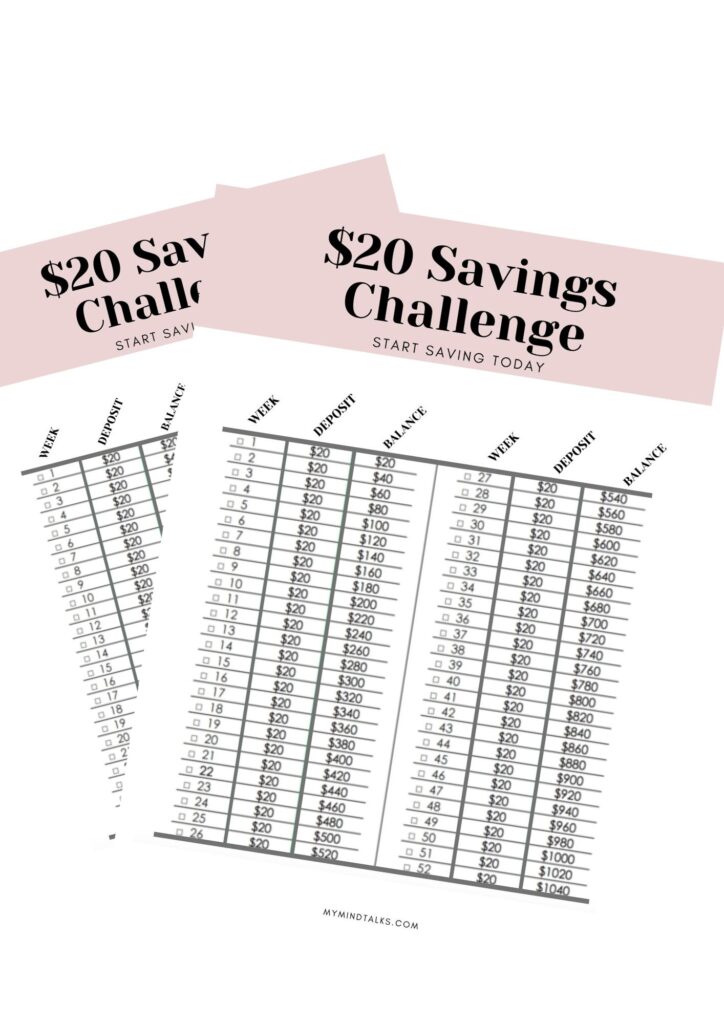

18. Take the $20 Savings Challenge

Take the $20 Savings Challenge. The idea is to transfer $20 every week to your savings account for a year, which is 52 weeks.

As a result, you will save $1,040 without noticing!

Pro hack #1: Open a certificate and transfer money there, so you can get dividends and save more.

Pro hack #2: Download this $20 Savings Challenge printable to keep track and visually see how many weeks you’ve got left!

Alright, here I listed 18 financial goals to set and crush this year.

Pin it if you enjoyed it and thanks for reading!

Now it’s your turn: What are your financial goals?

Read More:

8 Things To Consider When You Buy Groceries During The Pandemic

10+ Best Dave Ramsey Tips To Achieve Financial Freedom

The 7 Best Cash Back Websites To Save Money Shopping

These are awesome tips! I’d love to start earning a passive income. Thanks for your book recommendations as well. Super helpful! 😊

Thank you for sharing your love! Indeed, earning passive income is a great goal and I wish that you achieve it 🙂

So many great tips!

Thanks!